Erik Norland, CME Group

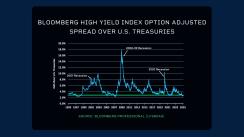

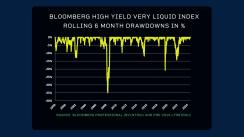

- U.S. credit spreads are narrower than almost any other time in history.

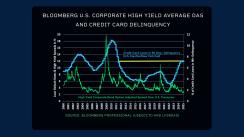

- Delinquency rates on credit card and auto loans have reached their highest levels in around 15 years.

The yield premium on high-yield bonds versus U.S. Treasuries of similar maturity is just about as narrow as it has ever been in history at only 2.8%.

Currently, there are plenty of warning signs that credit spreads may soon begin to widen. For example, delinquency rates on credit card loans have soared to their highest levels since 2011. Credit card delinquency rates were also soaring before the global financial crisis – well in advance of that widening of credit spreads that left corporate bond investors with large losses.

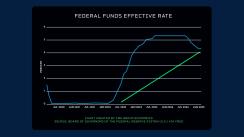

Looking ahead, investors may want to ask if the Federal Reserve’s monetary policy is also likely to contribute to a widening of credit spreads. While the Fed has recently eased policy by 100 basis points, rates are still 425 basis points higher than they were three years ago.

CME Group futures are not suitable for all investors and involve the risk of loss. Full disclaimer. Copyright © 2025 CME Group Inc.